Fed's Fisher: No need for QE3

By Felicia Taylor, CNNmoney June 1, 2012 NEW YORK (CNNMoney) -- The elephant in the room - QE3 - is stomping around again thanks to that deeply disappointing jobs report. So, will the Federal Reserve open the floodgates and throw more stimulus into the market? Or will it remain on the side lines, jawboning that "policy options are available ... should it be necessary."

NEW YORK (CNNMoney) -- The elephant in the room - QE3 - is stomping around again thanks to that deeply disappointing jobs report. So, will the Federal Reserve open the floodgates and throw more stimulus into the market? Or will it remain on the side lines, jawboning that "policy options are available ... should it be necessary."Sometimes words are enough to calm the markets, sort of like a lullaby. Other times, you need action - as we've seen via QE1 and 2 and Operation Twist. The answer, of course, depends on who you ask.

Traders clearly want more QE. Ken Polcari, managing Director at ICAP Corps, said from the floor of the NYSE Friday that one way to avoid the global economy falling back into recession and prevent real panic is through stimulus. Economists are less certain. Tom Porcelli, chief economist at RBC Capital Markets, said he thinks the odds are high for QE3, but pointed out that more bond buying would just be a "sugar high."

Another round of stimulus won't necessarily result in job creation and that's what this economy needs to

start real growth again. The consumer won't get out there and spend until they are sure they can find, keep or secure full time employment.

Job numbers are dismal

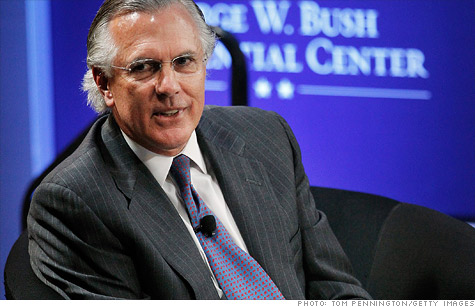

But at least one Federal Reserve president is indicating he's not in favor of more QE. Richard Fisher, president of the Federal Reserve in Dallas said, "there is already surplus liquidity sitting on the sidelines. Nearly $1.7 trillion in excess private bank reserves are on deposit at the 12 Federal Reserve Banks, lying fallow."

Fisher pointed out that long-term bond yields are already low as investors flock to the dollar and away from the euro.

"It helps to be the best looking horse in the glue factory! Monetary policy has done all it can, in my view," Fisher said.

Does the Fed have any bullets left?

Fisher is a well known inflation hawk and has consistently warned about the risks of too much stimulus. However, he is not a voting member of the Fed's policy-setting committee this year.

Still, he had some pointed words for politicians about how they, and not the Fed, should get the economy moving again.

"It is up to fiscal authorities to incent the private sector to get on with job creation and stimulate economic growth and final demand, using the ample and cheap funds the Fed has made available."

In other words, get on with it Congress.

No comments:

Post a Comment