UK manufacturing growth grinds to a halt

The Markit/CIPS Manufacturing Purchasing Managers' Index (PMI) dropped to 50.5 in April from a downwardly revised 51.9 in Marchby Phillip Inman guardian.co.uk1 May 2012

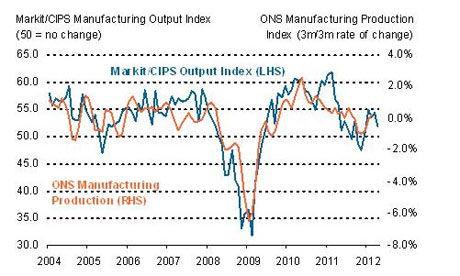

UK manufacturing PMI, up to April 2012. Photograph: Markit

UK manufacturing PMI, up to April 2012. Photograph: MarkitUK manufacturing growth slowed to a virtual standstill last month after a drop in new orders from the eurozone hit confidence across the sector.

The Markit/CIPS Manufacturing Purchasing Managers' Index (PMI) dropped to 50.5 in April from a downwardly revised 51.9 in March, keeping the sector just above the 50 level which separates growth from contraction.

The reading, the lowest since December, will disappoint the chancellor, George Osborne, who is already reeling from news last week that the UK has entered a double-dip recession after two consecutive quarters of negative growth.

Economists had forecast only a small dip in growth to 51.5 after a string of positive surveys through February and March had raised hopes of a recovery. The weak data could force the Bank of England's

monetary policy committee (MPC) to reconsider its view that the economy is strong enough to move ahead without further quantitative easing (QE).

Markit said the crisis in Europe was hurting British factories. Although activity did expand in April for the fifth month running, the data also showed the sharpest fall in new export orders since May 2009.

"What manufacturers really need to see is a marked improvement in new order inflows," said Rob Dobson, senior economist at Markit, which compiles the PMI survey.

"It seems that weaknesses in our major trading partner, the eurozone, are starting to hit home, especially for consumer goods producers," he added.

Labour has blamed the return to recession on government policies that have rejected stimulating the economy in favour of cuts in public spending and investment, rather than supporting manufacturers and the wider economy during turbulent times for the world economy.

Osborne and the prime minister, David Cameron, have gone on the offensive in recent days to blame the weakness on the euro crisis. Cameron went further in dampening people's expectations before local elections on Thursday, saying the euro crisis would take several more years to overcome.

At its last meeting, the MPC appeared to back way from further purchases of government bonds to stimulate lending after nearing the end of a £325bn bond purchasing programme. It meets again next week.

A strengthening in sterling to its highest in more than two and a half years posed another threat to exporters by either sapping foreign demand for British wares or squeezing firms' profits via lower prices.

Production of consumer goods fell, while output of intermediate products such as car engines and investment goods such as factory equipment both rose.

Factory gate price inflation reached a seven-month high, even though manufacturers' costs rose at a much slower pace than in March. That may encourage hawks on the MPC to oppose calls for more QE.

No comments:

Post a Comment